Students and faculty respond to debt relief plan

On Aug. 24, the Biden-Harris Administration announced their Student Debt Relief Plan. The plan includes a one-time student loan debt relief for low to middle-class families. According to the U.S. Department of Education (USDE), undergraduate students who qualified for a Federal Pell Grant are eligible to receive up to $20,000 in relief. Students who did not qualify for a Federal Pell Grant can receive up to $10,000 in relief...

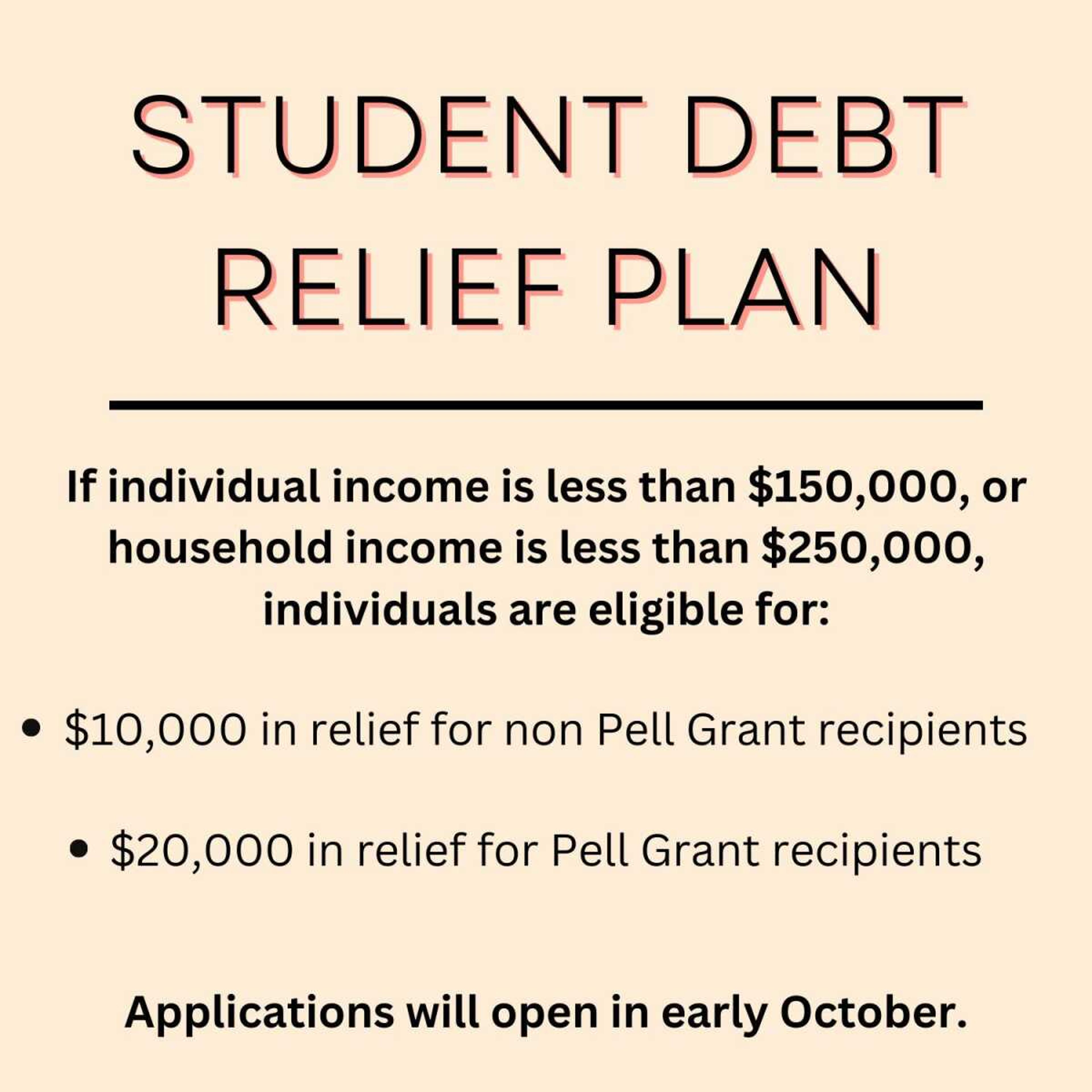

On Aug. 24, the Biden-Harris Administration announced their Student Debt Relief Plan. The plan includes a one-time student loan debt relief for low to middle-class families.

According to the U.S. Department of Education (USDE), undergraduate students who qualified for a Federal Pell Grant are eligible to receive up to $20,000 in relief. Students who did not qualify for a Federal Pell Grant can receive up to $10,000 in relief.

According to the admissions office website, about 40% of SEMO students use Pell Grants.

Director of Student Financial Services (SFS) Matthew Kearney stated he encourages students who are in debt to take advantage of Biden’s plan.

“I think any chance students get to lower their debt is always a good thing. I would definitely encourage students to look into [the plan] and make sure they have their T’s crossed and their I’s dotted, making sure that everything they need is submitted.”

Even though this relief is available, Kearney said students should minimize taking out loans unless they can compensate for the loans by working or utilizing their savings. He said if students need to take out loans, they should take out subsidized loans. Subsidized loans are interest-free until the student graduates. If students do not have the option of a subsidized loan and must take out a private loan, he recommends finding loans with the lowest interest rate possible.

Federal student loans which are qualified for relief as of June 30 are the William D. Ford Federal Direct Loan, subsidized and unsubsidized loans, Parent PLUS loans, Graduate PLUS loans and Consolidation loans. Other loans qualified for relief include the Federal Family Education Loan (FFEL) and the Federal Perkins Loan.

Political Science senior Luke Collins is hesitant about Biden’s student loan forgiveness plan. Collins believes the plan is good in concept, but said he is concerned about the national implications of forgiving up to $20,000 in loans.

“I think there’s a lot of impending debt which is causing students to struggle across the United States and I think the plan is a great idea, but if we’re forgiving, essentially, billions of dollars in student loans, how do we make up for that lost revenue? Then there’s obviously the criticism from people who have paid off their loans. I know somebody personally who paid off $10,000 in loans and was like, ‘Man, if I would’ve waited six months, I would’ve had $10,000 in my pocket’. There’s an obvious issue here,” Collins said.

Entrepreneurship junior Cassidy Klein believes many students take out loans because of the cost of general education classes on top of classes required for a student’s major. Klein said a lot of material taught in her general education courses was information she had previously learned in highschool.

“During my first semester here, I learned about the water cycle in a class. I'm not in college to learn about the water cycle. I'm in college to learn about business. The fact that we have to spend almost two years on just general education is insane. That's two years I could be out in the workforce with my degree. That's two years’ worth of student loans and two years’ worth of interest rates that are growing on those student loans,” Klein said.

The online application for student loan debt relief will be available in October 2022 on the Federal Student Aid website. To prepare, students should ensure they have a Federal Student Aid account created and update their contact information. Then, students are assigned a loan servicer, if they do not already have one. The loan servicer will reach out to the student once their debt relief application has been accepted.

Kearney hopes canceling student loans is not the ultimate solution the federal government has. He said he wants the federal government to try and fix the issue by bringing change within higher education.

“I think having income-based public service loan forgiveness can really help to get people in fields like social work or education. Those fields help to educate our children and the public’s well-being. The federal government should not lose sight of professions that might not be financially lucrative, but are certainly good. These are opportunities to do good work for our communities and our society as a whole,” Kearney said.

Students have until Dec. 31, 2023, to submit their application for relief.